- Crypto Is Easy

- Posts

- Weekly Rundown - February 4, 2024

Weekly Rundown - February 4, 2024

Flat

This AI Startup Investment is Winning

RAD AI has developed technology that transforms the $633B MarTech industry. Its award-winning AI tells brands who their customer is and how to best create content for them.

1) $27M raised from 6,000+ investors, including VCs, execs at Google and Amazon. Backed by Adobe Fund for Design.

2) Dubbed “essential AI” for brands looking to attract new audiences and boost ROI.

3) 3X revenue growth, clients include Hasbro, Sweetgreen, MGM and more.

83% Subscribed, Invest Before Feb. 16th, Closing Soon.

Disclosure: This is a paid advertisement for RAD AI’s Regulation CF offering. Please read the offering circular at invest.radintel.ai

Did you read my special report, Three Ways to Prepare for Bitcoin’s Halving? If not, read it now 🤩.

The halving seems far away, but it's only about two months ahead. That's not a lot of time to prepare. Get moving!

“Moving” is more than the crypto market’s doing. It’s gone flat for two months. Take a look:

It sure doesn't feel like it’s gone flat, does it?

Sometimes, truth is stranger than fiction. Maybe that’s why it's so hard to make heads or tails of what's going on in the crypto market!

We try anyway.

Make sure you got my most recent update from January 31, 2024. Once you step outside of the day-to-day movements and insanity of crypto, you’ll see everything is pretty much following its normal routine.

Your favorite influencers might not know what that routine is. After you get this update, you will.

Did you miss that update or any of the premium content? Upgrade to the premium plan now so you don’t miss anything else. You’ll also get:

👀 Direct contact with me.

📈 Video and written market analyses so you can make better investment choices.

🧐 Exclusive altcoin reports and special content to stay ahead of the competition.

Scroll down for poll results and some content you may enjoy.

In last week’s poll, I asked respondents to rate their crypto allocation: nothing, too small, too big, or just right.

More than 50% said their allocations were too small! Were they saying that in 2022 and 2023?

“Just right” came in second.

More people said they had no crypto than too much. This begs the question: why are they reading a crypto newsletter if they have no crypto?

Tap the comment icon to leave a comment. The icon is probably on the left side of the screen. It looks like this:

🚨🚨Today I'm publishing my thesis on what I think could be the defining feature of the next 12-24 months in crypto.

Settle in, this is a long one. The thesis is called:

"A Lack of Pretense That Any of This Shit Does Anything or Will Ever Do Anything"

Not financial advice. twitter.com/i/web/status/1…

— Travis Kling (@Travis_Kling)

4:29 PM • Feb 2, 2024

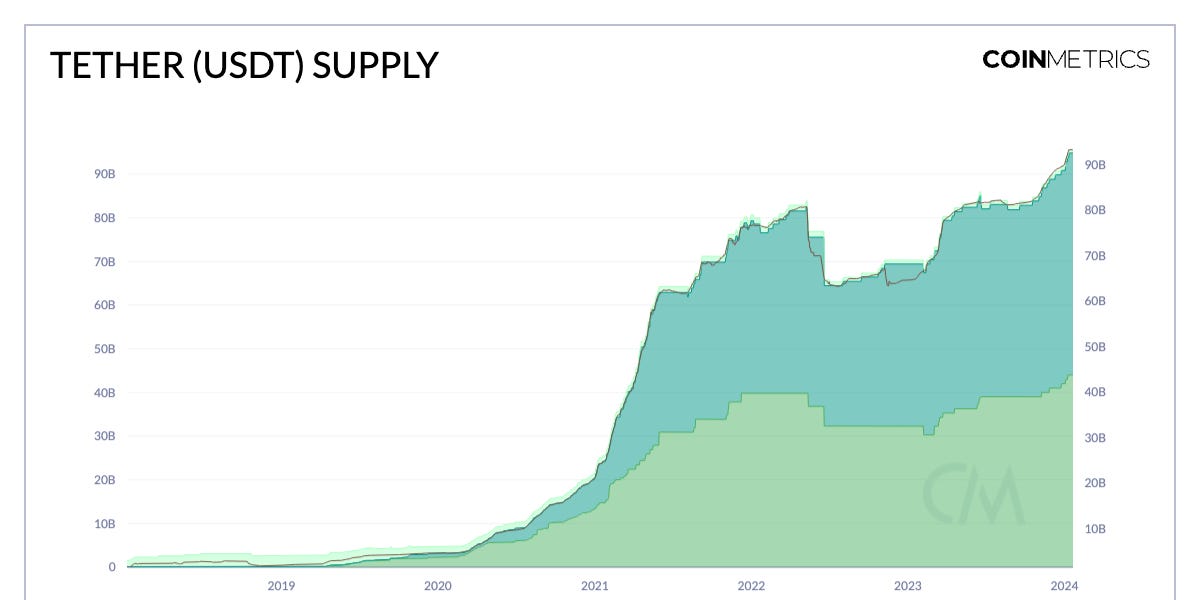

In all likelihood, USDT is a mix of real deposits and IOUs, just like your government’s money (tax revenue and bonds).

While that may not help you sleep better at night, it’s not necessarily a problem. People think 1 USDT is worth $1. As long as that’s the case, they’ll keep using it—and we will have to prepare for a collapse of USDT.

Hopefully, that collapse never happens.

Coinmetrics has a nice little rundown on Tether’s history, usage, and reserves. It's worth a read!

Bottom line: decentralized physical infrastructure, DePIN, fits the needs of machines better than legacy infrastructure.

My take: DePIN fits nicely with AI because it lets any network of machines operate autonomously. DePIN creates a shared pool of computing power, expertise, and throughput—the “vast, public, global networks of computing power provided by people and businesses all over the world, using their own assets and equipment in exchange for rewards,” mentioned in Wall Street and Crypto: When Wolves Lie Down With Sheep.

While memecoins, airdrops, and narratives may drive speculative enthusiasm, DePIN will have a more lasting impact. At least, once the initial FOMO wears out.

Why you should care: over the long run, real solutions may deliver bigger, more durable returns than shiny new tokens.

Relax and enjoy the ride!

Reply