- Crypto Is Easy

- Posts

- Weekly Rundown - July 16, 2023

Weekly Rundown - July 16, 2023

Warren Buffett is Secretly a Bitcoiner???

I’m looking for sponsors!

Put your brand in front of over 20,000+ active crypto investors with one of the highest-engagement crypto newsletters on Beehiiv. Tap the button below but don’t wait. You might miss your chance!

What a week for people who care about the US’s role in crypto!

Crypto bills got moving, ETF applications gained steam, and a court said cryptocurrencies are securities only if they’re offered like securities, not simply because they’re digital tokens . . .

. . . and Bitcoin’s price is the same today as it was a week ago.

What’s going on?

Perhaps it’s the bearish technicals or eerie similarities with late 2015 - early 2016, as noted in my market update from July 12, 2023?

In that update, I also talk about the “golden cross,” the US government’s Bitcoins, and a very important consideration when looking at “Bitcoin Dominance” and “Market Cap” charts to strategize your altcoin investments.

Scroll down for some content you may enjoy.

Bottom line: a US judge said the XRP token is not a security, but the SEC can sue Ripple for selling it like a security. If applied broadly, this means a token is or isn’t a security based on what people do with it, not its mere existence. Context matters.

My take: the ruling leaves a lot of important questions unresolved. It also changes no laws or regulations and has no weight outside of the Ripple case. Still, exchanges and cryptocurrency projects can point to this standard as a precedent in their defense (until another court overturns the ruling or Congress passes actual crypto laws). Every little bit helps! This is a good thing.

For a while, I’ve talked about applying common sense rather than a literal interpretation to US laws. This ruling brings the US one step closer to that approach. Let’s hope other judges take the same approach. Cryptos fit the definition of “securities” in the same way remote-control jets fit the definition of “planes” and riding mowers fit the definition of “motor vehicles”—but you don’t see aviation authorities going after kids because the kids didn’t file flight plans for their model Aermacchis and you won’t find any local government that forces people to get a title, registration, and special license for a John Deere.

Why we care: the Biden administration can persist in its haphazard, modestly-effective attempt to marginalize cryptocurrency but the US government is a lot more complicated than you might think. We have a lot of great people advocating for us and plenty more who agree that the status quo doesn’t make sense for crypto. Let’s not psych ourselves out just because grieving regulators lash out unreasonably.

Digital Asset News has my favorite take on everything that’s going on with the SEC and crypto, packaged into a short video. Watch it before you get too happy or sad about what’s going on.

In recent updates for premium subscribers, I’ve shown you some ways that market-wide metrics like Bitcoin Dominance and “TOTAL2/TOTAL3” are useful for appreciating larger market dynamics but don’t necessarily matter for your decisions.

In my July 12 update, I give another example, Aragon (ANT), one of the altcoins in my Altcoin Reports.

I added to my position in November at $1.90, as I noted for premium subscribers at the time. The token is about $4.25 today, up 30% against BTC and up 130% against the US dollar.

As the #188 largest crypto, it barely registers on TOTAL MARKET CAP and Bitcoin Dominance charts. It’s too small.

Most large altcoins will bleed forever, but they get over-calculated in the aggregate charts and market-wide metrics. Those metrics reflect the buyers of the past who didn’t sell yet. They skew toward altcoins with big market caps that will lose market share to newer and smaller projects. Those newer or smaller ones take their place eventually, but they won’t show up in those metrics until that happens.

You’d be shocked at the turnover in top altcoins from cycle to cycle. Take a look at my Advice for Altseason for examples of churn among the Top 30 from previous peaks-to-peaks and bottoms-to-peaks.

That advice is old but mostly still relevant. I’ll update it when we see signs of a potential altseason (not now).

If you want some fun, bookmark my report on the Top 100 altcoins and come back to it in two years. I’ll bet you’ll see a lot of names fall off as new ones take their places. It’s less than a year since I put the list together and it’s already changed!

(Priya in the Park will yell “YOU’RE CHERRY PICKING! ANT IS JUST ONE ALTCOIN!! WHAT ABOUT THE OTHERS!!!” Tell her to chill. It’s just one example to prove a larger point. You can find other examples in previous updates to prove other points, like how the price charts hide your actual results and the importance of factoring in rewards when calculating your returns—e.g., staking, delegating, running a node, etc.)

🚨BREAKING: Warren Buffett is a #Bitcoin 'er!

He's keeping it quiet (for obvious reasons).

But just look at the facts...🧵👇

1/

— Terence Michael 🍊💊 (@ProofOfMoney)

6:01 PM • Jul 9, 2023

Did you forget about Binance? Some of the world’s governments accused it of running a criminal enterprise. Nobody seems to care. “4,” they say.

Before you start throwing your fingers up, read the excellent analysis of Binance’s situation and potential outcomes from Alex’s Substack.

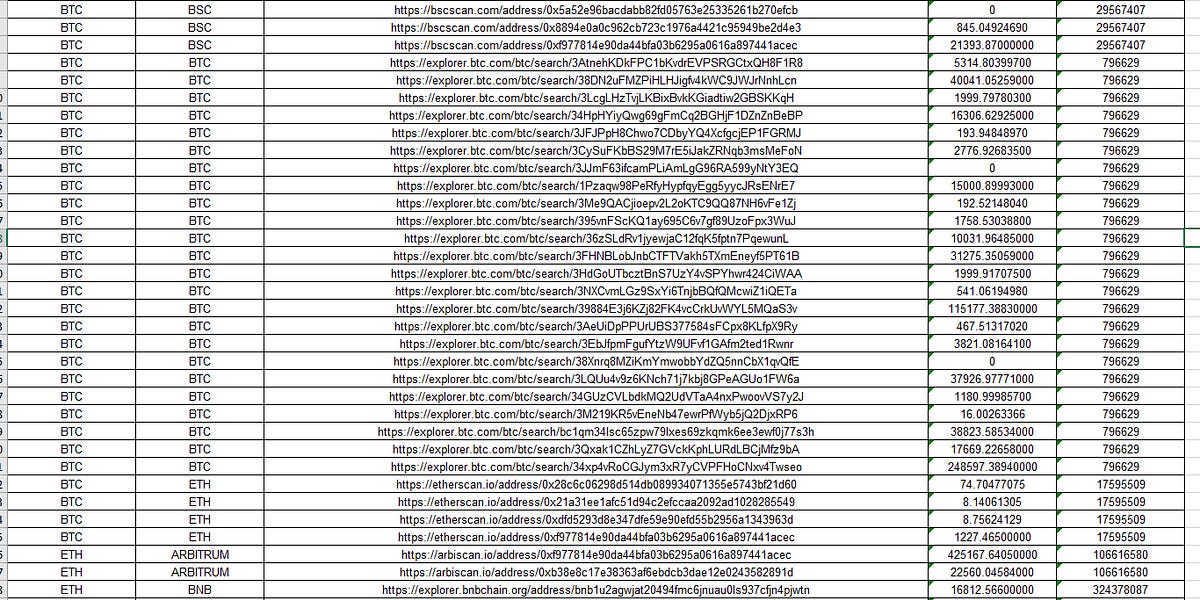

I’ve shared my own concerns about Binance at length based on activities that we can see or infer from on-chain behaviors. You know where I stand.

At the same time, it’s going to be very hard for the US or any entity to take down Binance.

(Binance.US is a different story.)

Just because a few governments accuse somebody of doing something bad does not mean they did anything bad. Even if they did, these matters often settle or the entity persists after its leaders go to jail.

More importantly, cryptocurrency’s success does not depend on any single entity. It’s arguably the only asset class that can operate regardless of what happens to the people who run it. The protocols and networks that grow around these assets are very difficult to dismantle (though they may fall apart on their own).

Please read the post and subscribe to Alex‘s Substack (he didn’t tell me to say that — in fact, he won’t know I shared this with you until after I post it!)

Bottom line: Shakeeb Ahmed exploited a smart contract to defraud the users of a DEX (purportedly Crema Finance). Essentially, he got the smart contract to accept fake data to put $9 million into his pockets.

My take: you might wonder why this case matters. After all, it’s crypto, frauds happen all the time! Rug-pulls, hacks, and straight-up FTX/Celsius “lie to everybody.”

In this case, Shakeeb didn’t exploit the smart contract or its code, he actually wrote new code to dupe the protocol. He didn’t use the protocol to commit a crime, he turned the protocol into a criminal actor for his own benefit.

It’s not fraud, a rug-pull, or market manipulation, it’s a hostile takeover of a computer protocol. Like reprogramming a Toyota to kill people (without Toyota’s consent). Scary stuff.

Why we care: add this to the list of risks you take with crypto. No audit can protect you from somebody who can “trick” smart contracts. We can only take solace in knowing the transparency of blockchain makes these crimes very hard to get away with.

Are you looking to hire Web3 talent?

Connect with Recruit Rockstars for 50% off of their normal fee when you use my Recruit Rockstars referral link (I get a small reward when you do).

Relax and enjoy the ride!

Reply