- Crypto Is Easy

- Posts

- Weekly Rundown - September 1, 2024

Weekly Rundown - September 1, 2024

You're doing it again the way you always could

Experts say September is the worst month for crypto.

I guess that depends on whether you’re trying to buy into the market or sell out of it.

Since 2012, Bitcoin’s price has gone down most Septembers. It went up 3% in 2015, 7% in 2016, and in 4% in 2023. Otherwise, dumpage in the first degree.

Do we worry about that?

No. Bitcoin’s still following a familiar path with no signs of taking the key step I’ve talked about at length in my market updates, most recently the update from August 30, 2024.

In that update, I talked about what we need to see before we get too excited and shared insights into shifting dynamics that will matter for your portfolio and expectations.

Speaking of expectations, catch my August monthly issue, Crypto Investor Dilemma: Great Expectations or Great Results?

In that post, I looked at a crucial, long-term trend in the relation of a major US stock index to Bitcoin and shared some ways to prepare for what happens in the coming months.

Look for another market update this week, an altcoin report this month, and more goodies later this year. Scroll down for last week’s poll results, a hidden trade setup for premium members only, and some other content you may enjoy.

You can reply to this email to contact me directly. Or, use this button to leave a comment at the bottom of any post.

Did you miss the market update and private content? Upgrade to the premium plan now so you get those and:

👀 Direct contact with me.

📈 Video and written market analyses so you can make better investment choices.

🧐 Exclusive altcoin reports and special content to stay ahead of the competition.

Poll Results

In last week’s poll, I asked “Will Bitcoin go below $50k ever again?”

Participation was much lower than normal, but the results showed a strong tilt. 66% said Bitcoin will trade below $50,000.

What do I think?

I suspect some responders think that $50k will come in 2026 or 2027 as part of the next bear market. Before then, we’ll have a big boom, banana zone, etc.

Should Bitcoin’s price fall below $50k in the coming weeks and months, it will come one of three ways:

Substantial deterioration in the “macro,” e.g., a financial crisis or economic problems among large economies.

Sudden drop that resolves within days or weeks.

Shift in long-developing patterns and trends we’ve seen for months in the movements of stablecoins, movements of Bitcoins, and general composition of the market.

(The second option happens all the time—including last month—but it’s hard to predict or time.)

A trade worth taking?

In 52 Trades in 52 Weeks, Sankalp Shangari posted a structured trade on BNB, Binance’s exchange token.

52 Trades… has a pretty good track record if you follow its instructions. Set up and execute the trade exactly as described in the post.

As with the Telegram group I shared with premium subscribers in the August 18, 2024 rundown, I support having fun and trying to squeeze cash out of the market. Whatever you need to stay engaged in crypto.

This is not a trading newsletter but I’ll continue flag low-risk trading opportunities when I see them. 52 Weeks… delivers a new opportunity each week.

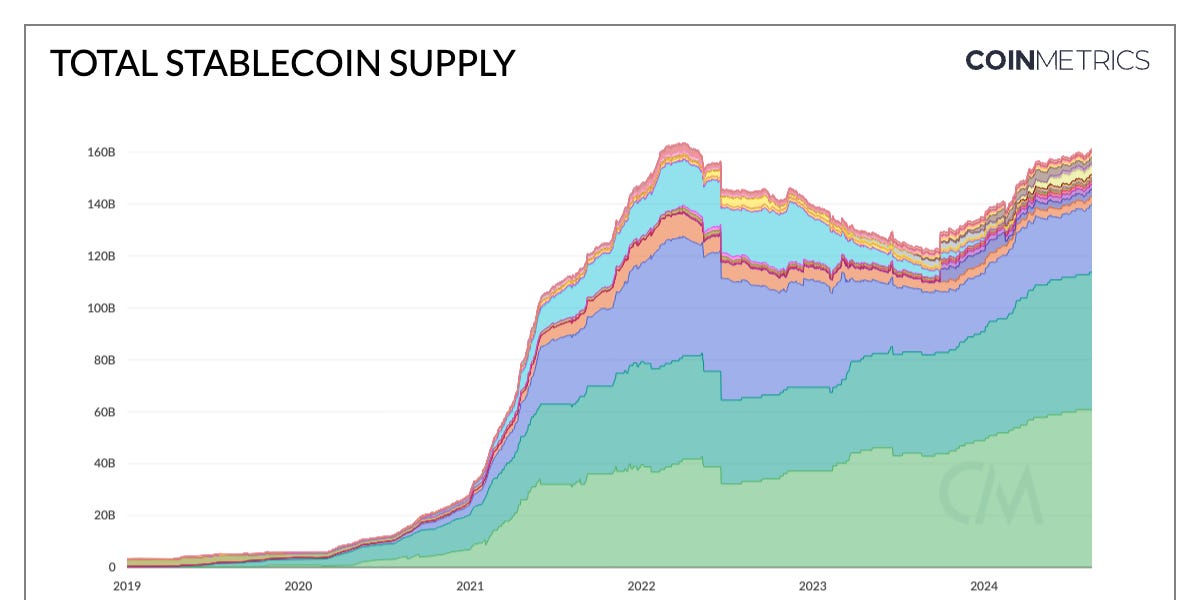

Coin Metrics posted an excellent summary of stablecoins and opportunities to make money with stablecoins.

Its post covers the various types of stablecoins and differences among stablecoins.

For years, the landscape was dominated by fully-backed stablecoins (e.g., USDC) and algorithmic stablecoins (e.g., the now-defunct UST).

More recently, developers have developed stablecoins that generate returns from yield-bearing assets or tokenomic engineering. This may seem boring, but it’s cutting-edge financial technology.

Imagine you can hold an asset that’s as stable as your government’s currency, readily used in common commerce, and also delivers yield to holders. Like a money market fund that you can buy coffee with.

Coinbase does this with USDC for people who transact on its platform, but it’s a single entity. If it fails, you’re screwed. Newer designs might eliminate this point of failure.

Sounds good but what’s the rub? Coin Metrics shares some perspective.

Relax and enjoy the ride!

Do you want to consult with me or just chat? Schedule time on Tealfeed!

Reply