- Crypto Is Easy

- Posts

- Oh, That Bull Flag

Oh, That Bull Flag

Crypto market update for July 3, 2025

Happy US Independence Day!

This is an especially joyous occasion for my friends in Great Britain, because you got rid of us! Could you imagine if you had to spend the last 250 years with us as part of your country?

Let’s get to crypto.

Do I sense excitement?

Bitcoin’s a whisper from last month’s highest price, just below its all-time high, and breaking out of a bull flag. It just needed to cool off before the next big rally.

Or is the opposite—growing concern or anger about the series of lower highs we’ve had since May? Impatience about the banana zone and new all-time highs? Soul-searching about your altcoins?

If any of those feelings sound familiar to you, today’s update has got you covered. Topics:

Video

TL;DW

About That Bull Flag

Another clue in M2 and other divergences

Claude says . . .

Altcoins in trouble?

I strongly advise you to read the summary below and watch the video update. You will miss too much if you only get one of them!

Video

Tap this image to watch the video.

To speed up the playback (shorten the playing time), use the gear button at the bottom of the video screen. A playback speed of 1.5 should do ok for most of you.

TL;DW

If you’re following the easy plan, you will buy when Bitcoin’s price goes below $72,000, with the option to start buying at $95,000. You’re constantly setting aside fresh cash for that opportunity.

If you also followed my deviations, you sold most (possibly all) of your Bitcoin at an average price of almost $100,000. Combined with the money you’ve set aside since April and opportunities to compound your gains along the way, you have a lot of cash.

If you haven’t sold any crypto, it’s not too late. You may not need to, anyway. It’s more important to make sure you’re prepared for what comes after the hype dies down, especially if that happens sooner than people expect, or if the market peaks at a lower price than you expect.

We’re buying dot.com investments in 2000, playing for whatever is left of the tail end of a multi-year, parabolic bull run. It’s a race to see whether legacy entities can buy faster than smart money can sell.

Since April, Bitcoin has followed a path similar to 2014, with today’s ETFs playing the role of Silicon Valley back then. The only major sources of inflows come from legacy finance and small buyers who missed the run from 2022 to 2025.

Plan accordingly.

If you don’t know what I’m talking about, catch up on recent updates. Start with last week’s update and work your way backward.

In a nutshell

Feel free to trade the bull flag (I’m not), but don’t invest long-term capital because of it.

Legacy demand continues to weaken.

About that bull flag

Are you looking for clues in the charts?

You’ll find some people talking about a bull flag on the daily chart.

A textbook bull flag will not have consolidation circled above, and the trendlines would be parallel. Let’s not be sticklers for lines on a chart. Close enough is good enough.

Whether the flag is textbook or fudgy, we have a bullish break of resistance after consolidation.

If you’re trading the markets, you can take a long position when Bitcoin’s price ends one or two trading days on or above the top trendline. These patterns work out about 2/3 of the time.

If you’re not trading the market, you can ignore.

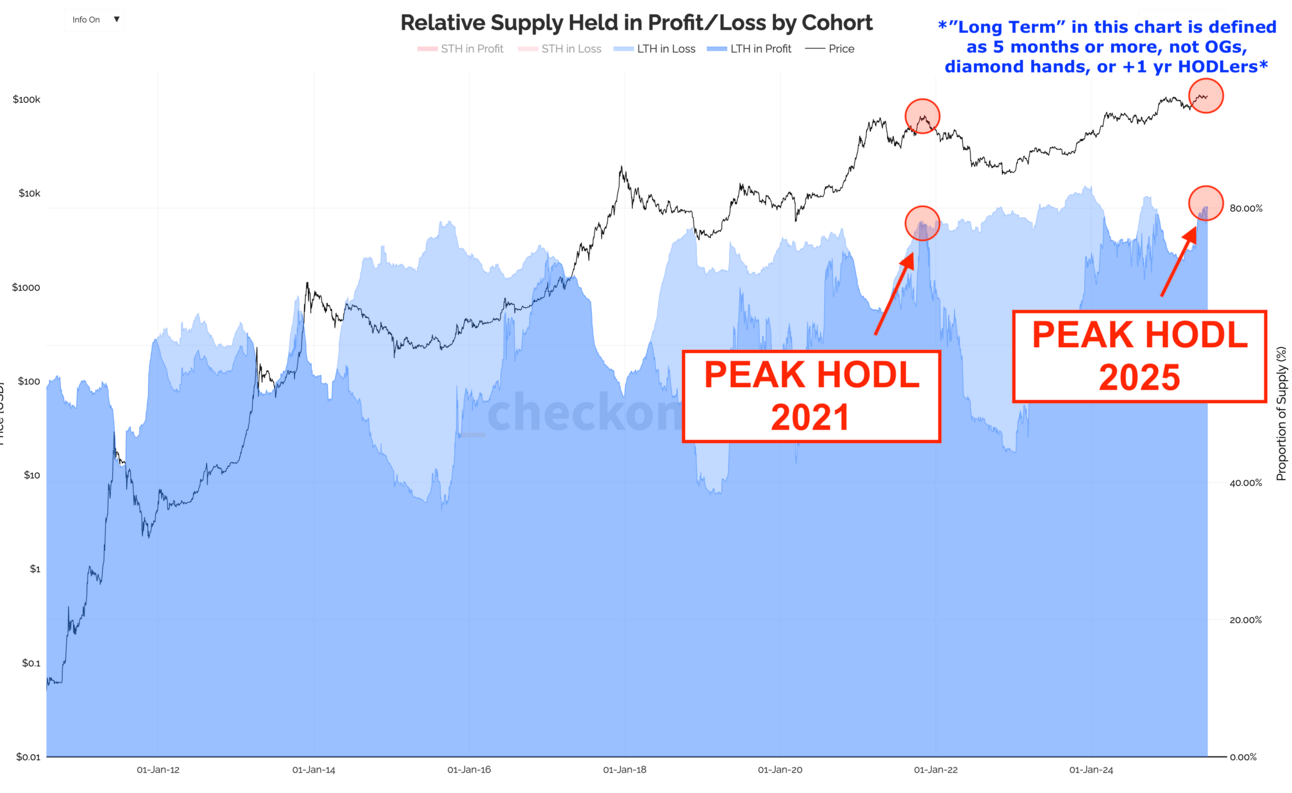

Do you want an even better bull flag in similar circumstances? When Bitcoin’s price had recently hit a new all-time high, HODLing had reached its peak, technical charts and cycle theories predicted glory, and everybody agreed the market would soon blast off?

You can look at the 2021 bull flag. Nice parallel lines, proper volume profile, nearly perfect. Price broke above the top trendline, consolidated briefly, then reached another all-time high, with a target of $100,000.

Take a look.

And that despite so many bullish confluences, for example, this “Peak HODL” chart from _checkonchain.

To be fair, that was a different time. We realized (in hindsight) that the HODLing metrics looked so good because people had deposited crypto on exchanges and lending platforms, then borrowed against those holdings to buy more crypto.

Today, we don’t know how many people are taking out margin loans through their brokerage using Bitcoin ETFs as collateral. Let’s hope they’re doing that without the fraud and mischief that went with 2021’s binge.

Can’t deny the bullish trading pattern. Just make sure you’re not getting too far ahead of yourselves and projecting an outcome that hasn’t happened (and, in previous similar circumstances, did not happen).

For more on this, skip to the 2-minute mark.

Another clue in M2 and other divergences

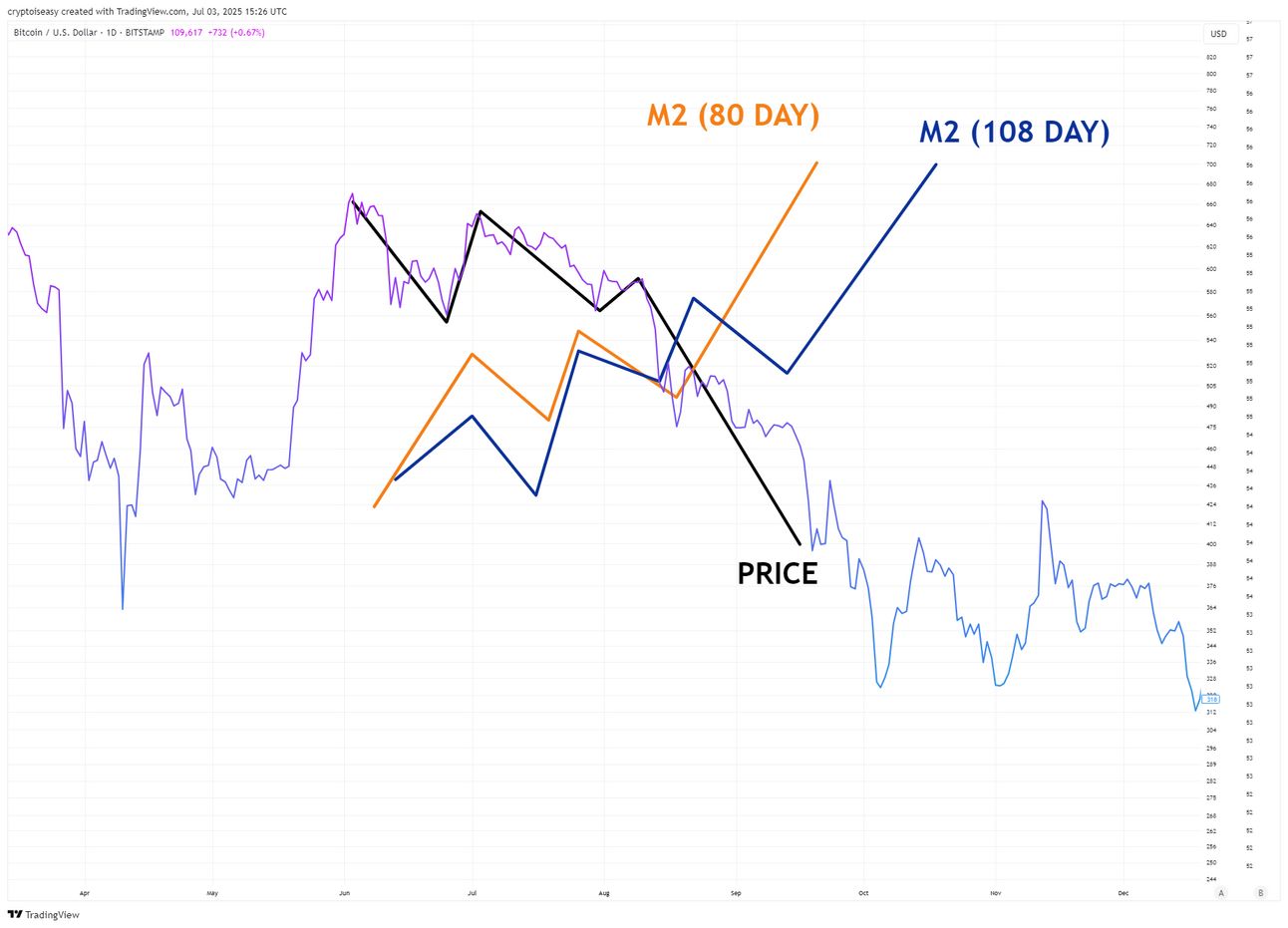

A few weeks ago, I said it was too early to claim M2 divergence from price, as we saw in 2014, 2018, and 2022.

Enough time has gone by. We can see the divergence more clearly, both on the 80-day lag and 108-day lag. M2 went up, Bitcoin’s price went sideways. As shown:

You can argue about the squiggles, but I'm just tracing lines. You can clearly see M2’s lines go up, Bitcoin’s lines go sideways and down.

It looks closest to 2014, when Bitcoin’s price went sideways for months as M2 climbed higher.

Will we need to wait months to see whether the similarity holds?

Yes. A perfect like-for-like move takes us sideways through August, potentially with another all-time high before turning downward. That's potentially another two months of uncertainty!

Of course, we won’t get a like-for-like move. No reason to wait or stress. It’s a sign of the times, not a prediction. It gives us a sense of what to expect within a very wide range of outcomes. One more clue, that’s all.

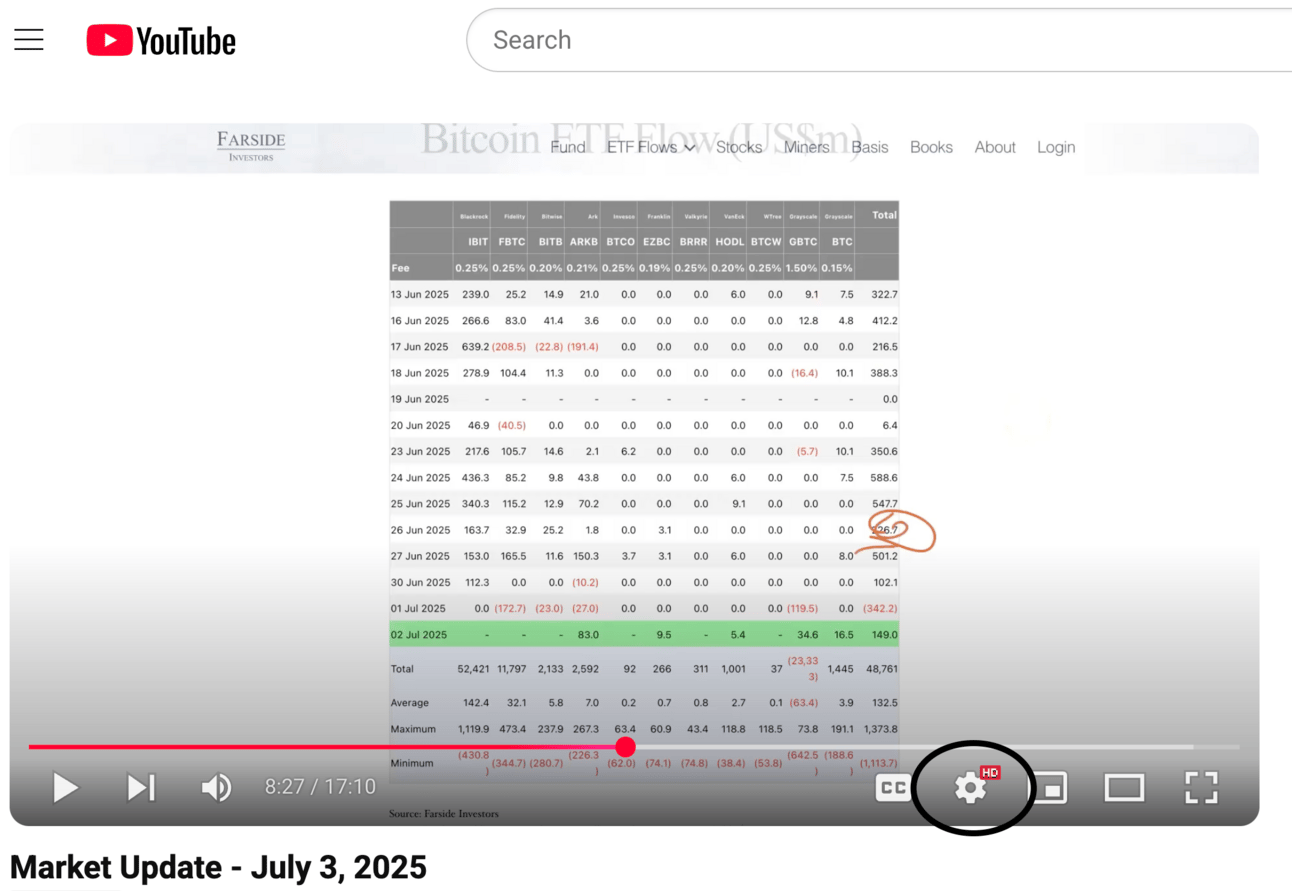

Likewise with Strategy฿ and the ETFs.

They still bring in a lot of inflows. More than $1 billion each week—though the amount continues to decline (albeit from a very, very high level).

The ETF chart looks different than previous versions. In previous versions, I accidentally averaged the change in flows over 7 days, rather than the total amount of flows. Directionally, they’re still accurate and both versions tell the same story, but they look different.

On net, these vehicles bring way more money in than out.

We don't know if those trends will continue. But, if you believe the claims of massive institutional FOMO and booming buys from legacy entities, you need to find some reason to explain why big money interest is waning, not growing.

You're probably wondering how this can be. Price keeps going up!

First, technically speaking, in a strictly dictionary sense, Bitcoin’s price has trended down since May. As of this update, it’s lower than June’s high, which is lower than May’s high. Watch the video for the chart (or pull it up on your own, every trading chart will show this, though plain price charts strip out the intraday swings).

Second, we don't see a lot of selling or trading volume relative to historical benchmarks. So you don't need a lot of buying pressure to keep price high or moving up.

For more on this, skip to the 5-minute mark.

Claude says . . .

Last week, I asked ChatGPT for pushback on my analysis. It's nice to have feedback from somebody who doesn't care about your feelings or what you think of them. Read our conversation:

I asked similar questions to another bot, Claude.ai, which agrees you can make a strong case that we’re in a late bull market / early bear market situation, though it walked back the probability upon my further questioning. It also presented some scenarios, actions, and invalidation points.

Some of those scenarios are quite dramatic. I find Claude generally prone to exaggeration and sensationalism, less accurate and more error-prone than ChatGPT. But it’s a conversation, so worth consideration.

At the end of the conversation, it gave equal weight to “consolidation before a big explosion” and said ETF outflows would devastate the market because they’re the primary price support mechanism while organic buying is weak.

You can read the conversation:

For more on this, skip to the 12-minute mark.

Altcoins in trouble?

I'm still waiting for my SWTH sell orders to fill. I sold a substantial amount of my altcoin exposure earlier this year, some at a gain, some at a loss.

The overall altcoin market is still in its ideal zone relative to Bitcoin on my chart of altcoin dominance, which strips out BTC, ETH, and the big stablecoins to see how much money’s going into the millions of smaller tokens rather than the big ones.

Altcoins can realistically pace or outpace BTC for the foreseeable future (not necessarily our altcoins).

Of course, they will go down harder when BTC falls. The point is not to avoid that, but to capture more upside than you might lose on the downside, relative to BTC, when averaged across a group of altcoins.

In general, I can't fault somebody for buying a token when it's down 90% and the overall market’s in the ideal zone on that chart. You'll get 50-90% drops no matter when you buy—bull, bear, or altseason.

Which altcoins?

Start with my altcoin reports.

Each altcoin has its unique circumstances, tokenomics, growth drivers, and other variables that make it impossible to generalize about its prospects. Some buck the trends. Others deviate for months before falling in line.

I'm starting to see some soul-searching about altcoins. Doubts, regrets, etc.

Oddly enough, that generally reflects an opportunity to buy, even if just to see how things go in the coming weeks and months. Often, altcoins get a boost at the tail end of Bitcoin rallies.

I prefer to wait for blood in the streets. As such, I’ll consider buying altcoins again when the chart reaches any of the zones outlined in my altcoins chart, which strips out ETH and the big stablecoins.

That’s at least 35% lower than today’s level. No clue when that will come, only that it will, and I want to make sure I’m ready for it.

In preparation, I’m researching the top 100 altcoins for a “top 10 of the top 100” list that I’ll publish as a report for premium subscribers (i.e., you).

For more on this, skip to the 14-minute mark.

An AI-written haiku based on this post:

Legacy and charts,

Bull flag flaps on waning winds—

Altcoins watch and wait.

Relax and enjoy the ride!

Reply