- Crypto Is Easy

- Posts

- Prepare for Peaks, Plan for Bottoms

Prepare for Peaks, Plan for Bottoms

You can make up for bad timing. Complacency kills. The June 2025 issue.

I subscribe to a newsletter that brags about buying at $25,000 in late 2023.

They told their readers to sit on their hands for the entire bear market. They had 67 weeks to buy at lower prices, but they didn’t. That’s what they’re bragging about.

How much did you lose by waiting?

After taking a big chunk of money out of the market in January, these writers said they will never sell Bitcoin again.

I suspect they’ll change their minds once Bitcoin’s price goes high enough.

Are you waiting for Bitcoin’s price to hit $1 million? Is that why you’re buying it at $100,000? For the 10x?

I'm old enough to remember when people bought Bitcoin for an open, public, permissionless, borderless, neutral, censorship-resistant way to send and receive money. Or a hedge against the legacy financial system. Or protection from a loss of civil liberties.

Those days are gone.

Now, it's a way to make money faster than your government can destroy it. Not a bad thing, but it certainly changes your motivation.

Where you stand depends on where you sit

You want to be in the same position as today’s OGs. They bought at $10,000 and sold at $100,000—a 10x return.

The gurus would say they’re stupid. Think of all the money they’re leaving behind! They sold early. Bitcoin will go to $1 million. They’re going to miss out!

Mind you, when Bitcoin’s price was $10,000, the gurus said the same thing about people who sold after buying at $1,000.

Are you sure they sold too early? Isn’t it possible you bought too late?

For a different spin, listen to the AI bots discuss this post on their podcast, Crypto is Easy AI!

Those $10k OGs came back for more when Bitcoin’s price dropped to $3-6k. Those $100k OGs will come back for more when Bitcoin’s price drops to $50-70k.

Will you? When you do, will you have enough money to make the most of that opportunity?

Good work, if you can get it

You get wrapped up about timing and price, getting in and getting out at the perfect moments. The truth is, you don’t have to. Instead, you can wait for the market to give you opportunities and take them when they come.

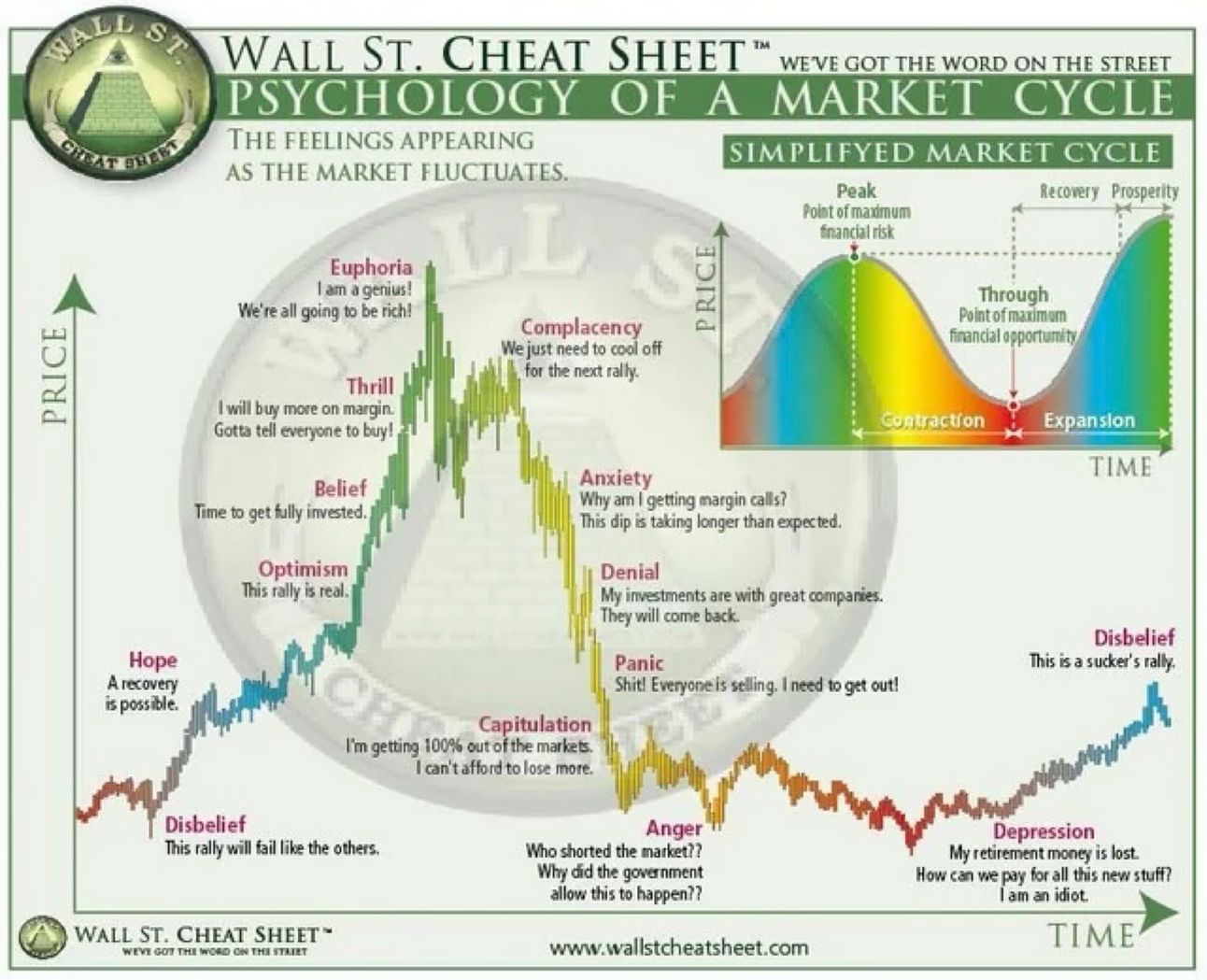

When do they come? Look at the Wall Street Cheat Sheet.

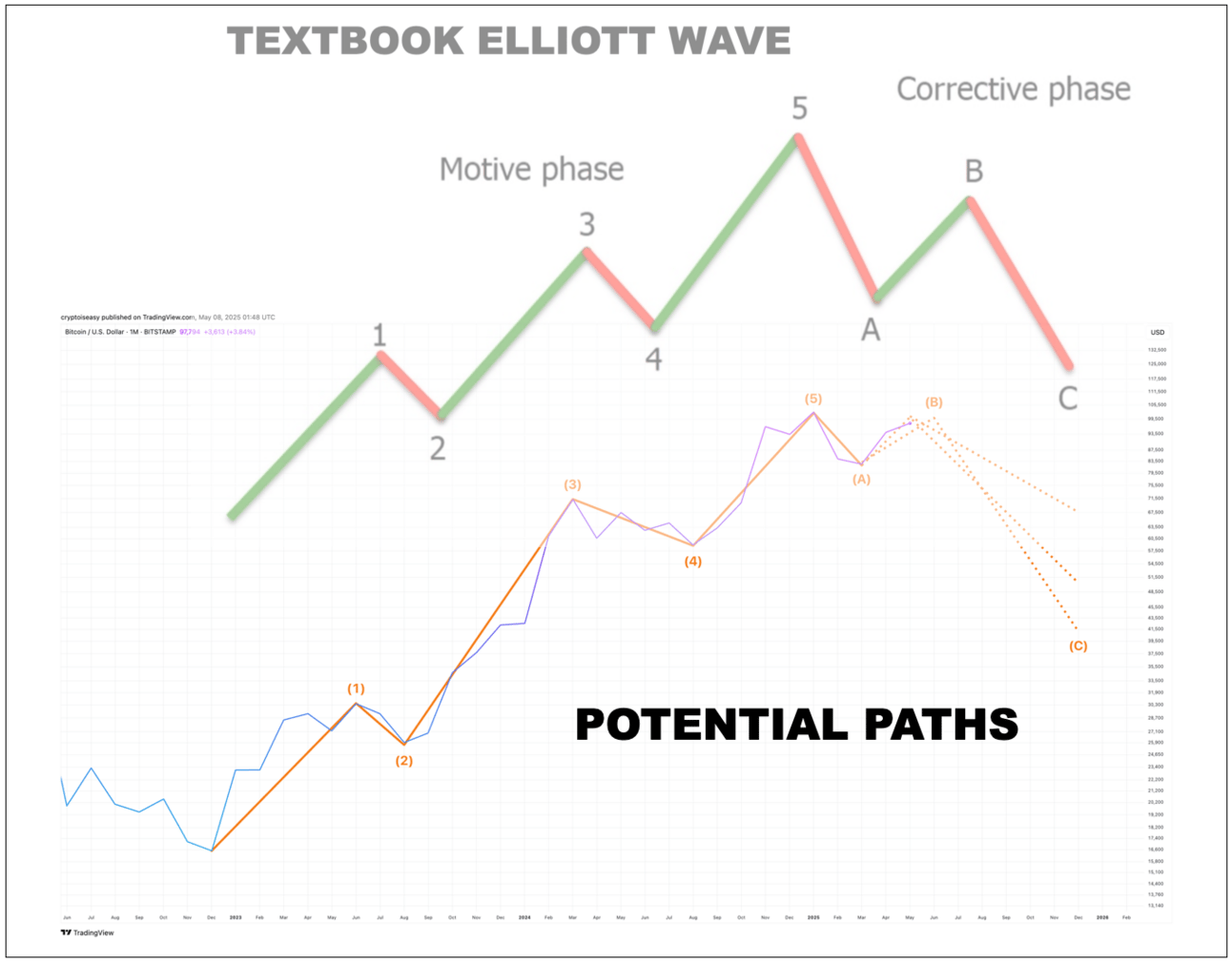

Or, study Elliott Waves Theory.

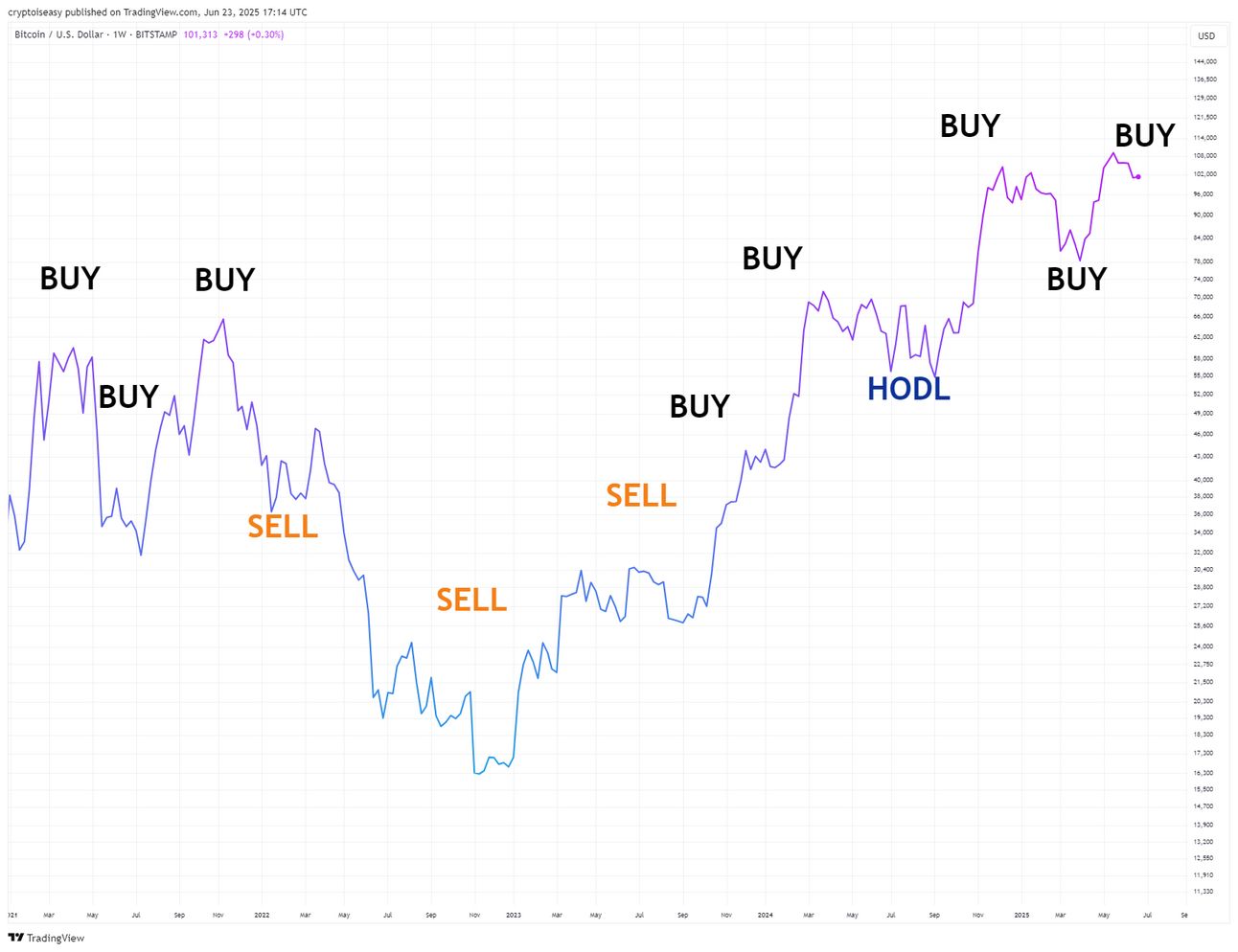

I follow some of the gurus. Few told you to sell in 2021. A handful told you to buy after the collapse of lending platforms in 2022 or the malaise that lasted through 2023.

Some told you to take profits below $32,000. Many advised buying into the peaks of early 2024 and early 2025. Plenty said not to buy in the summer of 2024.

Pretty much all of them tell you to buy now.

In other words, do this:

All of these gurus delivered great results. Better than anything you can get in legacy markets. That’s the beauty of Bitcoin: you know it will go up.

But not always

You also know it will always bring drawdowns that last months or years.

The biggest winners in crypto maximize their capital for those times. One out of every four years, you can buy at will. Two out of every four years, you get great opportunities.

If you wait for those years, you won’t need gurus. You won’t need to spend $600 to $6,000 each year on fancy newsletters (or $180 on this one). You won’t need to stress over data models and cycle theories.

There’s a reason you can do so well buying blindly with fixed amounts on a fixed schedule without regard to price or market conditions (i.e., dollar cost averaging). You’re betting on an asset with massive growth potential and huge tailwinds within a big, long-term uptrend.

It’s hard to beat that strategy.

The easy plan does better, on average.

A plan for all seasons

With this plan, you’re up 200% on average, up 9% at worst, and up 1,700% at best.

If you took the trades and deviations along the way, you could be up as much as 5,400% or down as much as 2% at today’s price of $100,800.

Where you fall depends on how much and when you bought or sold.

All told, when you stick to the plan for the long run, you can expect 2-3x return on your investment every 2-3 years. Dollar cost averaging yields a 2x every 3-4 years.

When you’re not buying, you’re setting aside fresh cash for the next opportunity.

Today, that means sitting on your hands.

This may feel bad. Everybody’s telling you to throw everything into the market now.

At the very least, wait for Bitcoin’s price to go back to the buying zone.

Prepare

Your mind is running hot about how much money you'll make this year and every year after.

That means you probably missed the run from $16,000 to $90,000. You’re chasing the tail end of a 3-year bull market in the hopes that Banana Zone and altseason make you rich.

Sadly, I live in the US, so I can’t risk my financial fate on a hypothetical surge that depends on fickle sources of capital entering an overbought asset after a 600% upswing when even the biggest bulls predict a huge crash within six months.

You may not need to take such precautions.

Bitcoin will always bail you out and some altcoins will do amazing things, but the best results come from the 500% upswings. Catch those and you’ll have options now:

Sell to harvest losses or capture gains

HODL

Trade a little

Borrow against your holdings

Did you miss that chance?

You have only one option: hope the market keeps going up.

As such, organize your financial affairs to make sure that you have plenty of cash to take advantage of the down years. When the bear market comes, you’ll still buy higher than the ultimate “macro bottom,” but you’ll have a lot more upside without the rush or stress of trying to get your timing perfect.

I’ll keep you posted in this newsletter.

Also consider your taxes, cash flow, job security, time horizon, financing costs (if you borrowed money), and other factors that make your decision specific and personal.

Two people can buy and sell the same token at the same time for the same price and get different financial outcomes depending on their circumstances.

Always another option

Mark, I’m still down!

Join the club. Everybody’s in the same spot with some part of their portfolio.

You still have options.

For example, SWTH is down 99% since its peak in 2021. If you allocated when I did and took advantage of the staking program, you're up about 100% since 2020. Some did better, some did worse.

Let's assume you're down 99% on your investment and never participated in any earning opportunities. Some options:

Book a 99% loss as a tax deduction.

Buy enough SWTH to double your tokens. Thanks to modern accounting rules, you’ll have the option to sell 50% after the next 2x tax-free. When you put the same amount into a different token, you have to find another way to offset taxes on your “free double.” Stick with SWTH, and your tax break is already built in.

Stake and contribute to liquidity pools for passive rewards while you keep the unclaimed losses for a future tax deduction.

Buy more as a long-term investment.

Do you want help identifying your options with tokens in your portfolio?

Schedule a portfolio review or consultation on Calendly.

Pick your perspective

While plans help, expectations matter more. Happenstance can make your experience different from somebody else's, even if you take the same approach.

For example, after I put out a sell alert when Bitcoin’s price hit $68k in 2024, the market ranged from $62k to $74k over a few weeks. When the time came to buy again, we bought for months between $50-65k.

When you look at a chart, it looks great.

Strictly speaking, you should have come out ahead.

Not necessarily.

If you sold at $62k and bought at $65, you ended up worse. To you, I'm an idiot and the alerts suck.

If you sold it at $74k and bought at $50k, you ended up better. To you, I'm a genius and the alerts are vital.

Nothing changed about me, my analysis, or my decisions.

The truth is, you will never get your timing right. You will always leave money on the table. You’ll either lose 50% by waiting too long to buy—like the newsletter at the start of this post—or you’ll lose 50% by waiting too long to sell.

Fortunately, you can make up for bad timing. Complacency kills. Appreciate the circumstances and act accordingly.

You get mad about selling too much before a peak or cutting your losses too soon.

Why aren't you mad about buying too little in 2022 and 2023? I am.

Why did I hold back? I could’ve maxed out all of my lines of credit and sold all of my other investments for Bitcoin. I lost a lot of money from under-investing when the opportunity came along.

While everybody else uses 2025 to sell the peak, I'm using it to make sure I'm prepared to buy the bottom.

Bulls until Q4

Permabull Teeka Tiwari told his subscribers to plan to sell this year. He warned them that he’ll push out sell alerts too early, too low, to make sure they capture the biggest gains.

That doesn't make literal sense, but you get his point. Even he appreciates the importance of capital preservation in times like these.

A photo of Teeka

Many other permabulls also plan to sell in Q4, when they say the market will explode. Will they and their followers drag down the market enough to preempt that explosion?

What if that explosion doesn't happen? Do you have fresh cash or deep lines of credit to draw from when the market’s depressed and it seems like institutions and influencers have abandoned you?

Hope so.

As noted in many updates, the only measurable sources of inflows come from small buyers and legacy entities. Meanwhile, psychological and structural models match what you see at the end of bull markets and the start of bear markets.

As I mentioned in the June 19 update, it's a race to see whether legacy entities can buy faster than OGs can sell. That’s why 2025 is all about the “macro,” not crypto-specific drivers.

The models look fine, but they all disagree with each other. Many of them suffer from skew and statistical drift. Some have already hit “peak” levels. Learn more in my report on data models and cycle theories.

What kind of banana is this?

2025 brought a strange market with odd quirks.

We haven't seen a traditional “altcoin cycle,” where capital rotates from large caps to medium caps to small caps to micro caps.

Relative to their respective sizes, the Ethereum ETF has outpaced Bitcoin’s net inflows since April, yet ETH’s price has lagged BTC.

We’ve spent six months in the banana zone, but Bitcoin's price has gone sideways.

Banana Zone

Cryptocurrency is a marathon masquerading as a sprint. They sell you on the sprint—the hype, the quick flips, the 50% gains.

The real winners wait for opportunities to make 200 to 500% gains. That way, when everybody else comes in for their 50%, we are set.

That can’t happen today.

Tomorrow? Next month? Next year?

We shall see. That’s the excitement.

The bigger question is whether you’ll stick around long enough to get that chance.

Relax and enjoy the ride!

Reply