- Crypto Is Easy

- Posts

- Market Update - August 14, 2025

Market Update - August 14, 2025

Crypto market update for August 14, 2025

The US economy posted its highest monthly and annual layoffs since COVID. The Eurozone says its manufacturing sector shrunk as inflation outpaced GDP growth again.

Tough sledding for central bankers. Everybody wants lower interest rates but core inflation remains persistently above preferred targets. Experts predict a near-100% certainty that the Fed will cut rates next month. On what basis?

Rates are a weird thing.

In 2021, the markets peaked well before any rates got hiked. After crypto bull market started in 2022, the Fed pumped the effective funds rate from 4% to 5.5% by July 2023. Bitcoin literally went “up only” on the back of a 40% jump in US interest rates.

Fortunately, we know the Fed is a faith-based institution whose decisions do not seem to change the path of US employment or US economic growth.

We’ll have to take things as they come.

If you’re getting excited over recent pumps, good! So far, 2025 has delivered the worst performance of any bull market year (see proof below). We need reasons to get excited.

Topics for today’s update:

TL;DW

The short squeeze rally

Some metrics

Altcoins

Ethereum’s recovery—return to normal?

Please watch the video and read the summary! You need both to get the full impact.

TL;DW

If you’re following the easy plan, you will buy when Bitcoin’s price goes below $75,000, with the option to start buying at $105,000. You’re constantly setting aside fresh cash for that opportunity.

If you also followed my deviations, you have a lot of cash generating 4-10% annual yield while you wait for the market to settle down.

If you haven’t sold any crypto, it’s not too late.

You may not need to, anyway. It’s more important to make sure you’re prepared for what comes after the hype dies down, especially if that happens sooner than people expect, or if the market peaks at a lower price than you expect.

If you took the long position from the July 3, 2025 update, play it tight in case we get that 2021 scenario or revert to our previous path, one that matches most closely with 2014.

We still see the bearish divergence and warning signs on the weekly trading chart, suggesting momentum isn’t as strong as Bitcoin’s price makes it seem.

It’s more signs of the times, not something you can plan around. Price keeps going up because of external factors, not inherent strength.

You’re betting on outside forces boosting the market—macro, institutions, FOMO, etc—rather than insiders putting their money where their mouths are.

The problem is, liquidity dries up faster than conviction.

I understand why you might feel like the vibe is off. They told you Banana Zone would bring parabolic growth but Bitcoin’s price is up less than 30% so far this year—its worst performance in a bull market year ever, despite numerous new all-time highs.

To boot, we have no altseason and ETH has barely beaten BTC’s returns since January 1.

Fear not.

As long as the market’s willing to buy debt and equity from Saylor and other Bitcoin treasury companies, your dreams will stay alive. Legacy investors will continue to subsidize corporate Bitcoin buyers while Aunt Sally and Uncle Morton put a little into ETFs and Tether keeps pumping the markets with fake cash.

Until they don’t.

We picked up some free Bitcoin on last month’s ETH/BTC trade. I’ll keep looking for new low-risk trades. It’s the only way I can feel comfortable playing the market now or telling you to do. You don’t want to get trapped short on cash when Bitcoin goes below $70k because you’re trapped chasing after a moonshot that never comes.

I picked up some DOGE “just in case” we see another altcoin pump. It was that or try a few spins of online roulette. I figure my odds are better with DOGE, for reasons I share below.

If that seems too blasé, I’ve spent enough time in crypto to know a 50-100% altcoin pump (or dump) is normal volatility in all market conditions and we’ll all miss the peak by 20-50% no matter when we sell, as this video explains.

We can always come back at lower prices. Bottom line:

We’re buying dot.com investments in 2000, playing for whatever is left of the tail end of a multi-year, parabolic bull run.

It’s a race to see whether legacy entities can buy faster than smart money can sell.

Treat every new all-time high as potentially the last.

For altcoins, think “crypto casino,” not “retire your bloodline.”

If you don’t know what I’m talking about, catch up on recent updates. Start with last week’s update and work your way backward.

In a nutshell

Watch out for bearish divergences, frothy sentiment, and lackluster performance.

Play it tight as we navigate the late-stage dynamics of a market propped up by legacy buyers, short squeezes, and potentially a new wave of retail FOMO.

The short squeeze rally

Since May, the three major market thrusts have coincided with short squeezes, artificial pumps that come from traders getting zapped.

CryptoQuant’s chart shows this most clearly, but you can find the evidence from any data source. Too many traders bet Bitcoin’s price would drop. When it didn’t, they had to buy Bitcoin to cover their bets, pushing the price even higher.

We’re more interested in the dynamics that follow.

Outside of the squeezes, Bitcoin’s price goes mostly sideways within a fairly wide range of prices. In two of the three squeezes, the market saw quick, sudden pullback at the start of the sideways action, such as today’s drop.

Those are hallmarks of upswings that lack broad support.

Upswings that start with a short squeeze and lead to further upside? That’s normal. Textbook, frankly.

Upswings that start naturally and consolidate after a swift rise? That’s normal. We see that often on short and long timeframes.

You can argue the left-most pump/squeeze fit both descriptions, depending on where you start your squiggles.

Those two most recent upswings start with short squeezes and consolidate after a swift rise—a sign of artificial stimulation. It’s simply a mechanical process that doesn’t substantively change anything.

From previous updates, we know leverage is high relative to volume. It doesn't take much to pump and dump at the market. What comes next matters more.

For more on this, skip to the 6-minute mark.

Some metrics

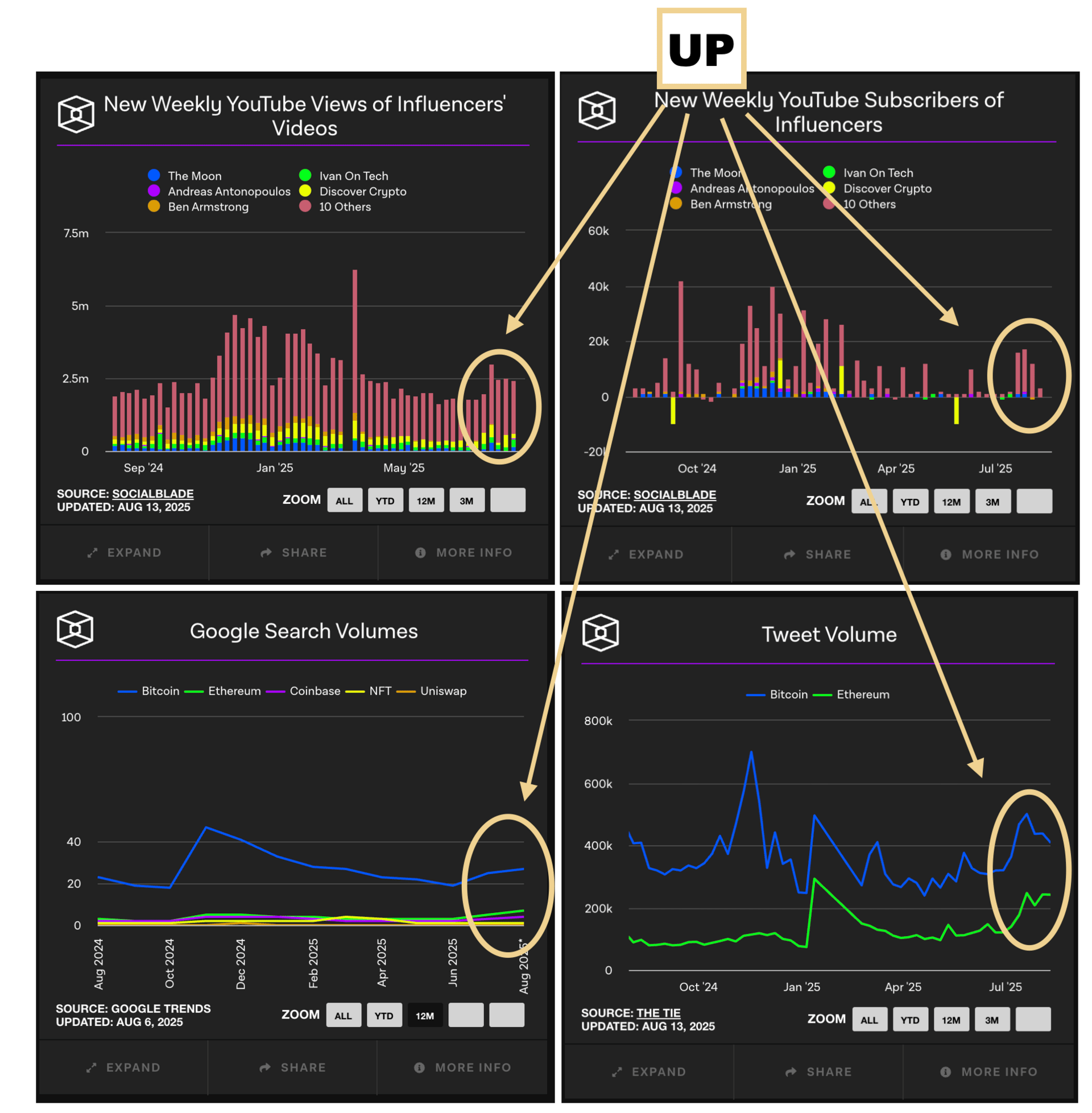

We don’t see a lot of trading volume or engagement, though searches and some social metrics have started creeping higher. Take a look:

We know from previous updates that a lot of buying pressure this year came from legacy entities playing catch up after missing the bulk of 2022-2025’s upswing while smart money cashes out.

Combined with a general lack of broad selling volume, it’s enough to keep the market afloat.

Some new buyers recently entered the market, mostly buying little amounts.

This month, the number of new addresses spiked.

This is something you don't see often. Most likely, this is Billy the Neighbor stashing some Bitcoin that he’ll ”never sell,” along with a bunch of newcomers getting their feet wet.

We see some evidence in the accumulation chart. Wallets with less than $1,200 in BTC spiked up bigly while other cohorts remained mostly sideways or down.

This makes sense. We are at the stage of the market where people who otherwise would never put money into crypto feel comfortable doing it. Samantha Down the Street has finally put in enough money to break the 0.01 BTC threshold.

Once we see big jumps in engagement metrics, we’ll think about selling more. Engagement is always the last thing to pump. I'll keep my eyes on that.

aSOPR, a barometer for the market, remains elevated, as it has for months. The market’s still frothy.

When you combine these signs, it’s a signal dumb money is starting to come in. Impatient, short-term focused buyers who don’t care about crypto and mostly do whatever Billy the Neighbor tells them to do or buy whatever random coin pops into their feed.

For more on this, skip to the 9-minute mark.

Altcoins

I still have not filled my sell orders for SWTH at $0.0018, nor has the altcoin market changed much since last week’s update.

You’re playing for the swings and random pumps, not trying to build wealth or retire your bloodline. These pumps don’t mean anything, they’re simple vagaries of the market.

In light of the behaviors mentioned out above and the frothy market conditions, I am setting sell orders when possible for all of my altcoins except RUNE.

These are “limit orders” that trigger automatically if we get a pump that comes out of nowhere. They're all arbitrary prices without any thought or reasoning, as follows:

ZEPH is a special case because I may have to HODL to zero. I’m finding the wallet very tricky and the liquidity protocol isn’t working out. The community seems unhappy and disengaged. One position to keep in my back pocket for when I need to reduce my taxes by taking a loss to offset gains elsewhere.

Mark, why are you HODLing RUNE?

Thorchain is the only truly decentralized DEX/DeFi platform. It has strong developers and a loyal community, and it has recovered from four major hacks/failures. The resolution of the most recent hack will weigh down RUNE’s price for some time. I’m not selling it.

No need to think about selling en masse until we reach the inflection zone on my altcoin dominance chart. At this level, the altcoin market tends to switch directions relative to Bitcoin, making it a natural spot to reevaluate your positions.

Some altcoins still trade at lower prices than when we sold them earlier this year, and many are down from their prices of last spring, the previous time we cashed out. They may never get back to either of those levels.

You may feel compelled to wait until you’re back to even, but often, once you get back to even, you’ll feel the urge to stay invested because “it’s going up.”

Don’t.

You’ll never get your timing right, but you can make up for bad timing. Complacency kills.

Given this reality and our present market conditions, continue to play it tight. In the list above, those prices are realistic, but I’m not planning around them. I'm going to pay more attention to the broader market, with the orders on the books just in case they catch a bid.

Also, buy some DOGE. I just did that. It has some momentum coming in. It’s a feel-good token. When people feel good, they buy DOGE.

You can catch it below $.25 and sell it near $.40 without losing too much sleep if it doesn’t play out, because you know it will stick around for the bear market and always pumps when the market recovers (and often in between, as shown in the video). As of this post, it’s $.23.

You’re playing the crypto casino at the tail end of an upswing, not trying to get life-changing returns.

For more on this, skip to the 12-minute mark.

Ethereum’s recovery—return to normal?

ETH has finally caught up to BTC for the year, now 2% higher.

Some people say ETH’s recent pump is a return to normal—the start of the altcoin cycle where money goes to BTC, then ETH, then large caps, then small caps, then microcaps.

My experience suggests they all pump, regardless of size. Some pump less, some pump more, some pump on Monday, some pump on Friday, and it doesn’t matter how big or small they are. It’s not a rotation.

I’m more inclined to see the ETH dynamics as another sign that the fate of 2025 rests on institutions, not crypto-specific drivers. Blackrock’s shilling ETH and the ETF flows prove it.

Some people say ETFs cause inflows to enter. That’s patently false (chart speaks for itself).

ETFs do, however, make it easy and accessible for big entities to buy when they otherwise would not have.

You’re getting excited but now’s no time to let altcoins run. The goal is to raise cash. If you haven’t raised cash yet, or you don’t have enough cash coming in, do that first.

I’ve been through this too many times. Every gets hyped and excited. A “cheery consensus,” as they say. You get left holding the bag buy every dip or HODLing every pump.

If you’re aiming to catch that last 20% (or 100% on altcoins), put your money in when the market’s down. You can’t do that if your capital is trapped at these prices or you’re waiting for everybody else to capitulate before you sell.

For more on this, skip to the 18-minute mark.

An AI-written haiku based on this post:

New money flows in,

Strength fades as the charts diverge—

Hope trades hands again.

Relax and enjoy the ride!

Reply